Most of us are familiar with the concept of mortgages. When you want to buy a house, you take out a loan and use your house as collateral for repayment. If you miss a payment, the lender can sell the house to recoup the money loaned to you. But what if the house sells for more than the amount still owed on the mortgage loan? Do you get any money back? What if the house was used as collateral for other loans (e.g., personal or business loans)? Cue every lawyer’s favorite answer: it depends!

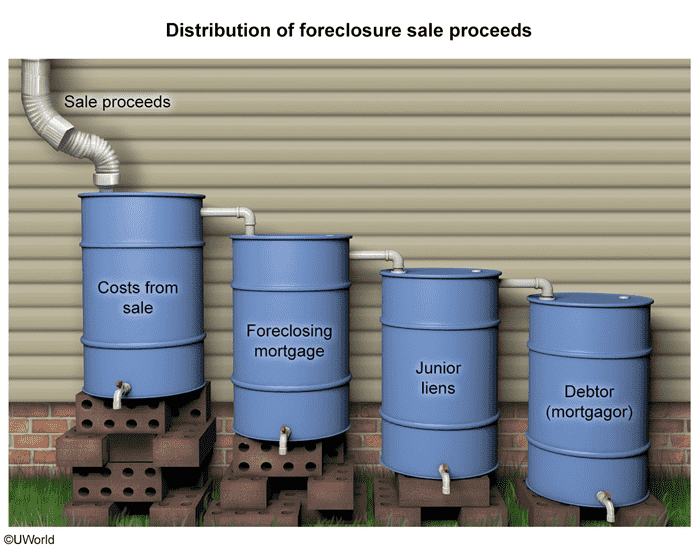

When property is sold at a foreclosure sale, the proceeds from that sale are distributed in the following order of priority:

- Expenses from the sale (e.g., attorney’s fees, court costs)

- Mortgage being foreclosed

- Junior liens, in order of lien priority

- Debtor, if any surplus remains

The amount owed in each category must be completely paid off before the proceeds can be used to pay off the next category. Here’s an illustration of this concept:

For example, imagine that a house is sold for $100,000 at a foreclosure sale, and the amounts waiting to be paid from those proceeds are as follows:

- Expenses from the sale = $10,000

- Mortgage being foreclosed = $60,000

- First junior lien = $20,000

- Second junior lien = $15,000

- Third junior lien = $15,000

This means that the expenses from the sale, the mortgage being foreclosed, and the first junior lien will be fully paid ($10,000 + $60,000 + $20,000 = $90,000). The remaining $10,000 will be used to pay part of the second junior lien. The third junior lien holder and the debtor will receive none of the proceeds.

The mortgage being foreclosed and all junior liens attached to the property will then be extinguished, but senior liens (if any) will remain attached to the property. This means that the purchaser of the foreclosed property may lose the property if any still-existing senior lien is not fully paid. As a result, prospective purchasers often subtract the amount owed on outstanding senior liens when calculating what to bid at the foreclosure sale.

Here’s one more priority: Use this tip when answering practice questions in the UWorld MBE QBank. Click here to access our QBank or purchase a subscription.