A woman borrowed $500,000 from a bank. She signed a note to the bank and secured repayment of the loan with a mortgage on a commercial tract that she owned. The note and mortgage did not contain a due-on-sale clause. Several months later, the woman conveyed the commercial tract to her business partner “subject to a mortgage to the bank, which the grantee assumes and agrees to pay.” The business partner then conveyed the tract to a buyer “subject to an existing mortgage to the bank.” Each grantee received a copy of the note and the mortgage.

After the buyer made several timely payments, no further payments were made by any party. The bank initiated a foreclosure action, naming the woman, the business partner, and the buyer as defendants. The foreclosure sale resulted in a deficiency.

There are no applicable statutes.

Against whom is the bank entitled to collect a deficiency judgment?

A) The business partner and the buyer. [16%]

B) The woman. [22%]

C) The woman and the business partner. [42%]

D) The woman, the business partner, and the buyer. [19%]

Note: The percentage next to the answer indicates what percent of UWorld users selected that answer option.

Explanation

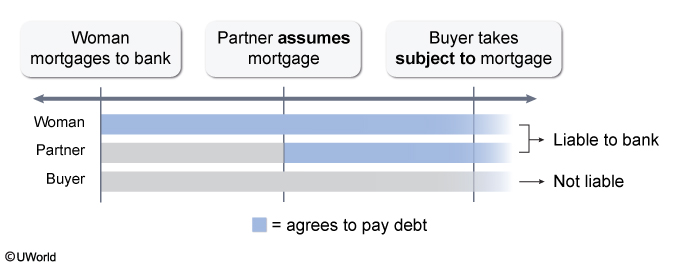

A debtor is free to sell mortgaged property unless the mortgage agreement states otherwise. After the sale, the mortgage remains attached to the property and the debtor remains personally liable for the debt secured by the mortgage. But the buyer’s obligations with respect to the mortgage depend on whether he/she:

- took the property subject to the mortgage – in which case the buyer does not agree to pay, and is not personally liable for, the debt or

- assumed the mortgage – in which case the buyer expressly agrees to pay, and is personally liable for, the debt.

Therefore, if a creditor forecloses on mortgaged property and the sale results in a deficiency—ie, the proceeds are insufficient to satisfy the debt—the creditor can obtain a deficiency judgment against the original debtor and/or any party who has assumed the mortgage.

Here, the woman mortgaged the commercial tract to a bank. She later conveyed the tract to her business partner, who assumed the mortgage. The business partner then conveyed the tract to the buyer, who took it subject to the mortgage. As a result, the woman and the business partner (but not the buyer) were each personally liable for the debt. And since the foreclosure sale resulted in a deficiency, the bank is entitled to a deficiency judgment against the woman and/or the business partner (Choices A, B & D).

Educational objective:

When a foreclosure sale results in a deficiency, the creditor can obtain a deficiency judgment against (1) the original debtor and/or (2) any party who has assumed the mortgage.

References:

- 55 Am. Jur. 2d Mortgages § 693 (2019) (deficiency judgments)..