Real Property on the Multistate Bar Exam (MBE) includes anything that grows on, attaches to, or is erected on land, including structures, roads, sewers, and man-made fences. Examples include real estate conveyances, title searches, leases, condominiums, mortgages, other liens, property taxes, real estate development, real estate financing, and determining property rights. Man-made objects are improvements, while vacant land is unimproved. Anything that may be removed from the land without causing harm is not considered Real Property.

Real Property Breakdown by Topic, Weightage, and Tested Questions

The National Conference of Bar Examiners (NCBE®) breaks Real Property into categories and subtopics. The MBE will contain 25 questions from Real Property. Here is what you should expect:

| Real Property Subtopics | Percent Tested | No. of Questions |

|---|---|---|

| Ownership of real property | 20% | 5-6 |

| Rights in real property | 20% | 5-6 |

| Real estate contracts | 20% | 5-6 |

| Mortgages/security devices | 20% | 5-6 |

| Titles | 20% | 5-6 |

| Total scored questions for Real Property | 25 | |

Ownership of Real Property

You will find about 5 MBE questions on property ownership. As part of its testing, the National Conference of Bar Examiners (NCBE®) likes to examine the differences and nuances between joint and common tenancies. Concurrent estates are properties owned by more than a single entity at a time. Some have rights of survivorship, while tenants in common do not.

Present Estates and Future Interests

In present estates, the holder of such an interest has the right to possession of the property. In the law profession, the meaning of “fee simple” is ownership without encumbrances. There is no time limit on how long a fee simple estate can last, and it can be sold, divided, devised, or inherited.

A defeasible fee is a fee simple estate that may terminate upon the occurrence of a stated event, i.e., when the estate is uncertain in duration or possibly infinite in duration. In most cases, a lifetime property, known as a life estate, is measured by the grantee's life expectancy (for example, "to A for life"). Language such as "to B after the death of A" can imply such a life estate.

Future Interests

Reversions in Future Interests occur when a grantor conveys less than they own (e.g., O conveys "to A for life"; O retains a reversion). A reversion can be alienated, devised, or inherited.

Remainders, whether vested or contingent, depend on conditions like an unborn child or an unascertained person. Executory interests arise in third parties either after a grantor's estate is interrupted ("shifting interests") or after a gap in possession ("springing interests").

Future interests, such as possibilities of reverter and powers of termination, give holders a present legal right to future possession, which is protected as property.

Rules affecting these interests include survivorship, class gifts, waste, and cy pres. If survival is not explicitly required (e.g., "to A for life and then to his surviving children"), a class member may not share in the gift. Implied survivorship conditions apply to widows, issue, heirs, or next of kin.

Cotenancy Types

The right of survivorship distinguishes a joint tenancy from a tenancy in common. Joint tenants lose their simultaneous interests in the property when one dies. Their survivors do not inherit it. The rights and obligations of co-tenants include a right to judicial partition, either in kind (a physical land division between co-tenants) or by sale. The courts will permit partition by sale if a fair and equitable physical division of the property is not possible.

Severance of a tenancy in common can result when the right of survivorship is terminated. Because co-tenants have an equal right to possess and use the entire property, relations among co-tenants can become strained when faced with the challenges of meeting all requirements.

Landlord-Tenant Law

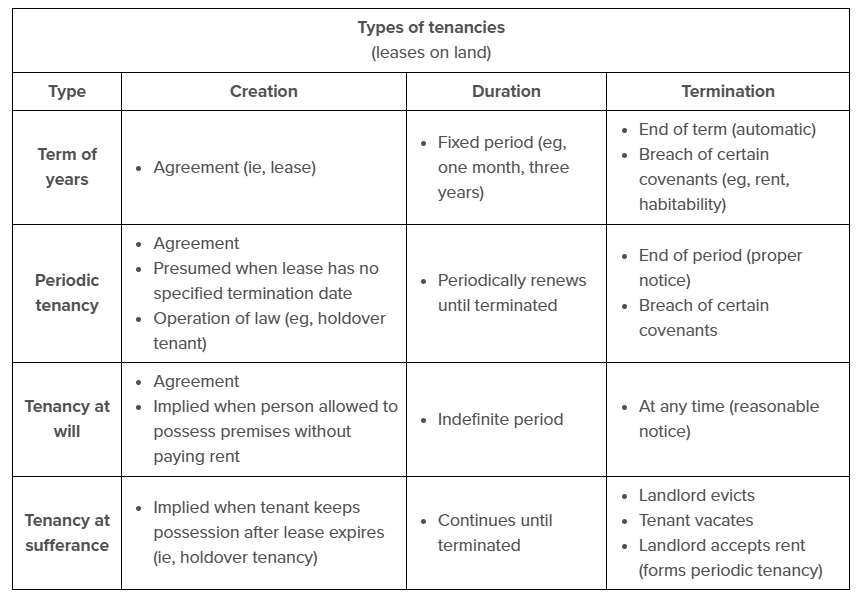

There are 4 types of tenancy agreements: fixed-term, periodic, boarding house, and service. In possession and rent, leases with a "failure to deliver possession" clause stipulate that the tenant does not have to pay until the landlord delivers possession. Transfers by landlord or tenant happen if the parties agree otherwise or if there is a tenancy at will. Landlords' and tenants' interests can be freely transferred.

Termination includes surrender, mitigation of damages, anticipatory breach, and security deposits. In most jurisdictions, residential leases include an implied warranty of habitability and suitability that cannot be waived, and local housing codes dictate the landlord's duties.

Special Problems

The rule against perpetuities (common law rule and statutory reforms): The perpetuity period begins when: (1) the testator dies, (2) the deed is delivered, (3) the irrevocable trust is created, (4) the revocable trust is revoked.

Alienability, descendibility, and divisibility of present and future interests: There is no need to reserve it expressly; it arises by operation of law. Fair housing/discrimination is covered well by the Fourteenth Amendment, which prohibits discriminatory state actions such as judicial enforcement of racial, religious, or ethnic restrictions on property transfers and uses.

Conflicts of law often relate to disputes involving Real Property: The following methods of description are given priority when descriptions are inconsistent or conflicting: natural monuments (e.g., oak trees), artificial monuments (e.g., stakes, buildings), angles, distances, names (e.g., Blackacre); and quantities (e.g., 300 acres).

Rights in Real Property

Rights in Real Property refers to the legal rights associated with owning real estate. Included are the rights of possession, exclusion, enjoyment, control, and disposition. Commonly tested topics include:

Easements, Profits, and Licenses

Easements are attached to real property and exist distinct and separate from the ownership of such property. Methods of creation include:

- Express: Deeds and reservations can be created using the county's public records. Dedication and acceptance can also create an express easement.

- Implied: Land rights are created when 1 party uses another's property continuously for 20 years; they relate to a limited and defined area; the owner has actual knowledge of the use, or it is so open and notorious that the knowledge must be imputed to the owner, and the use has been adverse.

The scope and apportionment are primarily determined by how the easement is created. A deed or reservation that creates an express easement defines its scope. Since easements are attached to the property, they run with the property regardless of property transfers through sales or other means.

Easements are terminated by the sale of the servient estate to a bona fide buyer without actual or constructive knowledge that the easement exists.

Unlike easements, a property can have a fixture. A fixture refers to a chattel affixed to land that ceases to be personal property and becomes part of the real estate. Fixtures pass with land ownership.

Zoning

A zoning ordinance is generally invalid if it lacks a reasonable connection to public welfare, is too restrictive, discriminatory, beyond the grant of authority, violates due process, or violates racial discrimination. The existence of violations of zoning laws and ordinances does not affect marketability.

Real Estate Contracts

The NCBE likes to test marketable titles that are reasonably free of defects and must be presented at closing.

- The real estate contract must be in writing and contain the essential terms (e.g., parties, description of the land, price) and the signature of the party charged.

- Acts of part performance may prove the existence of a contract, allowing enforcement of otherwise invalid oral contracts of sale.

- Leases over 1 year must be in writing as required under the Statute of Frauds.

- The time for performance must be clearly defined.

- If all remaining terms are transferred, it is considered an assignment.

- In real estate contracts, a signature is required unless an exception applies for part performance.

Remedies exist for the breach of any valid contract. Upon breach of the lease, the tenant may be entitled to reenter the property. In the case of a non-breaching party, damages (the difference between the contract price and the current market price, plus incidental costs) are available.

Concerning the marketability of title, except where expressly stated otherwise, every land sale contract contains an implied covenant of marketability. Further, the land-sale contract creates a bifurcation of title, where legal and equitable titles pass to each party. Covenants in a land-sale contract become part of the deed when the sale is completed, resulting in a merger.

Options and rights of first refusal: A right of first refusal or option to purchase which could be exercised later than the end of the perpetuity period is generally invalid. For fitness and suitability, the seller further has a duty to disclose latent material defects that are not readily visible and unknown to the buyer.

Mortgages/Security Devices

On the MBE, you will find about five questions regarding mortgages and security devices. A mortgage is a document used to prove the existence of a debt. Focus on the language used by the mortgagor during the transfer of property. The NCBE likes to test the distribution of proceeds from foreclosure sales. Always remember the order in which mortgages will be repaid.

Types of Security Devices

The Statute of Frauds requires mortgages to be in writing. In general, the law recognizes four types of security interests: mortgages, charges, pledges, and liens.

- Mortgages given for purchase money are known as purchase money mortgages (PMMs).

- Future advance mortgages are currently executed, but the funds won't be accessed until a later date.

- Installment land contracts are where purchasers agree to pay for land in installments.

- An absolute deed as security occurs when the debtor borrows money and issues a deed that appears absolute to the creditor.

Security Relationships

The necessity and nature of the obligation will determine the security relationship. An example would be when a landowner sells part of his tract of land and deprives another person or entity of access to public roads or utilities. As defined by lien theory, a mortgagee has a security interest in the property and the mortgagor owns the property until foreclosure.

The rights and duties before foreclosure hold that in possession, the person has the responsibility to manage the property prudently (i.e., not to waste it). The right to redeem and close the equity of redemption holds that if the debtor pays off all their debts against the property (all payments due and fees), the foreclosure will be stopped.

Foreclosure

Notes and mortgages with acceleration clauses must be redeemed in full. In order of priority, proceeds are applied to expenses of the sale, attorneys' fees, and court costs; then to the foreclosed loan principal and accrued interest; and finally to the mortgagor.

Deficiency and surplus hold that the mortgagee retains a personal cause of action against the mortgagor if the proceeds are insufficient to satisfy the mortgage debt. In equity, the mortgagor may redeem the property at any time before the foreclosure sale by paying the debt.

Transfers

The mortgagor can transfer property by assumption and transfer subject to grantees becoming primary liable to lenders, while the original mortgagor becomes a surety. As a result of every mortgage deed, the mortgagor and mortgagee have rights and obligations.

The application of subrogation and suretyship principles will not impede the surety’s rights of subrogation, even if the suretyship is for compensation. Restrictions on transfers include due-on-sale clauses found in most modern mortgages. These clauses give the lender the right to insist on full payment after the mortgagor transfers any interests in the property without their consent.

Transfers by mortgagees include the discharge of the mortgage. As a mortgage secures an obligation (e.g., due consideration, duress, mistake, fraud), defenses in an action against the mortgage are also defenses in an action against the obligation.

Titles

The MBE will have about 5 questions on the title to the property. The recording act affects priority battles regarding the title to the property and mortgage priority. The NCBE offers many opportunities to test your recording knowledge! It is possible to change the common law result through a recording act. Remember the rule of common law: first in time, first in the right.

Remember the general rule of adverse possession: A title vests in a possessor if the owner does not take action to evict them within the statutory period.

Transfer by Deed

To be valid, a deed does not require donative intent, delivery, or acceptance consideration.

Requirements for Deed

A valid deed requires writing, a competent grantor, grantee identity, words of conveyance, an adequate description of the land, consideration, grantor signature, witnesses, and grantee receipt.

A general warranty deed, a special warranty deed, and a quitclaim deed may all convey property interests that are not leaseholds.

Real estate contracts outline the crucial details of the sale, such as closing dates, possession dates, key transfers, who pays utilities and property taxes, what items remain with the land, and how the seller will leave it in good condition.

Persons Authorized to Execute Documents

All documents requiring the buyer's signature during a real estate closing require an individual's signature. Usually, photo identification is required.

Transfer by Operation of Law and by Bill

In a will, a grantor specifies how they want property disposed of at their death. With an ademption, the property specified in the will no longer belongs to the estate when the testator dies. In common law, exoneration applies when a testator dies owing a mortgage debt on property devised in a will. A gift to a named beneficiary that is not provided for in a will expires if the beneficiary predeceases the testator.

Title Assurance Systems

Recording acts ensure the subsequent purchaser of value must have been aware of a covenant at the time the purchase was made, whether by inquiry or on record. Land registration and land recording are two types of title systems used worldwide. The information is stored in indexes. When searching a tract index, look at the page indexed by block and/or lot describing the property.

A chain of title records ownership transfers for property and is imperative to establishing ownership of all manner of real property. A deed from a subsequent purchaser is recorded in the chain of title, allowing a subsequent purchaser to be entitled to record notice. There are always hidden risks, such as undelivered or forged deeds. In void deeds, the grantor may have been deceived or never received the deed (i.e., she did not realize she was making a deed).

Title Insurance

Title insurance guarantees the existence of a good record title to the property as of the policy's date and promises to defend the title in litigation. It is possible to encounter unique problems, including estoppel by deed and judgment and tax liens. There are also covenants in some general warranty deeds. A covenant of seisin states that the grantor possesses the estate they purport to convey. When the grant is made, they must have the title and possession.

How to Study for Real Property on the MBE

The MBE covers many areas of law, but they aren't necessarily equally tested! Focus on the areas within a subtopic most likely to appear on an MBE. The NCBE booklet outlines frequently tested issues for each subject.

Among them are:

- Contacts of sales and closing, which must be in writing, contain the correct legal language and terms, and satisfy an implied warranty of transferable title

- Recording acts that often use the common law default rule of “first-in-time, first-in-right”

- Title and lien theories determine the destination of the title

- Present and future interests are covered in more detail above

Concurrent estates are divided into 3 types: tenancy in common, joint tenancy, and tenancy by the entirety.

It is important to remember that the MBE is a national exam. It is therefore recommended that you ignore local laws and research the views of majorities and minorities. Seven subject matter committees draft the MBE questions, so they handle each Real Property MBE practice question individually.

Practice

The bar exam requirements call for lots of knowledge and memorization. Keeping up with all the legal terms and laws is challenging. Mnemonics and flashcards can be useful. A flashcard can include a quiz, practice question, or both. Combining these 2 study methods will better prepare you for the MBE.

Real Property Bar Exam Sample Questions and Answers

Here are a few sample Property Law questions from UWorld's MBE QBank:

A teenager was riding a bicycle when she saw a classmate walking toward her. The teenager rode quickly toward the classmate, knowing that he would think she would run into him on her current trajectory. The teenager was not purposefully trying to harm or touch him. The classmate saw the teenager riding toward him and yelled at her to stop. The teenager swerved at the last moment and avoided hitting him. The classmate had a panic attack because he thought that the teenager would hit him.

Is the classmate likely to succeed if he sues the teenager for assault?

| A. | No, because the teenager did not make contact with the classmate. | |

| B. | No, because the teenager did not purposefully try to harm or touch the classmate. | |

| C. | Yes, because the teenager acted with the requisite intent. | |

| D. | Yes, because the teenager's conduct was extreme and outrageous. |

An adverse possessor can acquire title to land owned by another if his/her possession of the land is:

- Open and notorious – apparent or visible to a reasonable owner

- Continuous – uninterrupted for the statutory period

- Exclusive – not shared with the owner

- Actual – physical presence on the land and

- Nonpermissive – hostile and adverse to the owner.

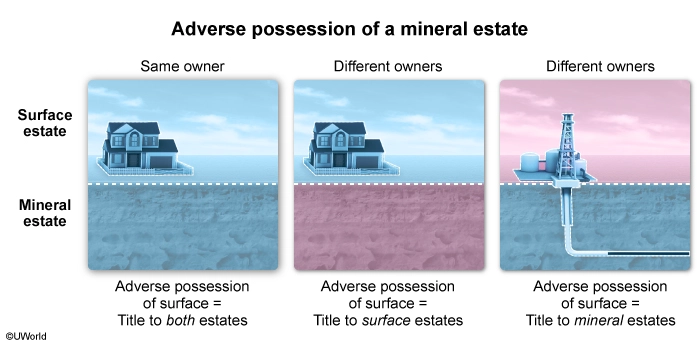

If the surface and mineral estates are owned by the same party, then the adverse possessor will acquire title to both estates—even if only one estate is actually possessed. But if the mineral estate has been severed from the surface estate (ie, the surface and mineral estates are owned by different parties), then the adverse possessor will only acquire title to the estate that is actually possessed. The mineral estate is actually possessed when the adverse possessor mines or drills wells on the land.

Here, the neighbor purchased the mineral estate from the man, thereby severing the mineral estate from the surface estate. And since the woman merely lived on the property for the 10-year statutory period—she did not attempt to mine or drill a well on the mineral estate—she actually possessed only the surface estate during that time (Choice D). This means that the woman did not adversely possess the mineral estate, and the court is not likely to award her title to that estate.

(Choice B) Adverse possession of a mineral estate requires the commencement of drilling or mining operations. Merely signing a lease of the mineral rights is not enough.

(Choice C) A deed need not be recorded to be valid, so the neighbor's failure to record has no impact on whether the woman adversely possessed the mineral estate.

Educational objective:

If a mineral estate has previously been severed from the surface estate (ie, surface and minerals owned by different persons), then an adverse possessor can only acquire title to the mineral estate by actually possessing the minerals (eg, by mining or drilling wells).

A baker borrowed funds from an investor to purchase a plot of land on which the baker planned to build a new bakery. In order to secure repayment of the loan, the baker signed a nonnegotiable promissory note and executed a mortgage to the investor.

Five years later, the investor sold her promissory note to a credit union by endorsing the note and promptly delivering it to the credit union. Due to a downturn in business, the baker was unable to make payments on the mortgage. The credit union now seeks to foreclose on the baker's plot of land.

If the court denies the credit union's foreclosure, what is the most likely reason?

| A. | The mortgage required a separate written assignment in order for the transferee-credit union to enforce the mortgage. | |

| B. | The nonnegotiable promissory note required a separate document for assignment to the credit union, so neither the note nor the mortgage transferred. | |

| C. | The transfer of the nonnegotiable promissory note modified the terms of the loan, resulting in a release of the baker's personal liability. | |

| D. | The transfer of the nonnegotiable promissory note without the mortgage was void. |

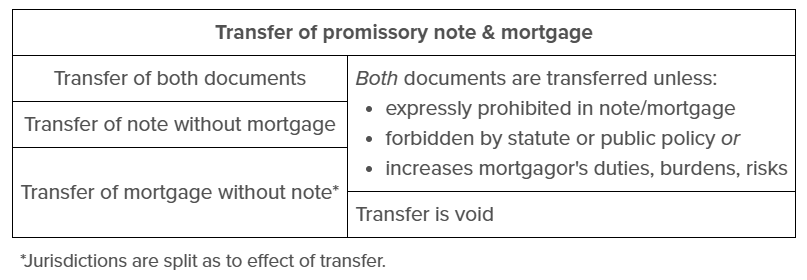

To finance the purchase of real property, a borrower typically executes two documents that serve as evidence of the debt:

-

Promissory note – a formal "IOU" that sets forth the terms of the loan. It is the primary evidence of the debt and is not recorded in the deed records.

-

Mortgage (or deed of trust) – a lien that secures the loan by attaching the debt to a real property interest and providing a means of enforcement (eg, foreclosure). It is recorded in the deed records to provide notice of an outstanding debt attached to the real property.

A promissory note can be assigned to another (an assignee) independent of the mortgage (Choice D). The mortgage automatically transfers with the note once the note has been properly assigned (unless the parties agree otherwise) (Choice A). A negotiable promissory note can be assigned by simply endorsing and delivering the note to the assignee. However, a nonnegotiable promissory note requires a separate assignment document to transfer ownership.

Here, the investor sought to assign her nonnegotiable promissory note by endorsing and delivering it to the credit union. However, this type of promissory note requires that a separate document be executed to assign this interest. The investor failed to execute such a document, so the note (and therefore the accompanying mortgage) did not transfer to the credit union. And since the credit union has no security interest in the land, it cannot initiate foreclosure proceedings against the baker.

(Choice C) A transfer of the mortgagee's interest in the promissory note changes the party who receives payment on the note, but it does not change the terms of the mortgagor's obligation. Therefore, the transfer of the note did not modify the terms of the loan or release the baker's personal liability.

Educational objective:

Although a negotiable promissory note can be transferred by endorsing and delivering the note to another, a nonnegotiable promissory note requires that a separate document of assignment be executed to transfer ownership.

- Restatement (Third) of Property: Mortgages § 5.4 (Am. Law Inst. 1997) (transfer of mortgages).

A worker took a temporary job of unknown duration in a distant state. The worker entered into a written agreement to rent a room in that state on a weekly basis, with the weekly period to start on Sunday and a weekly rent of $350, reflecting a per-day rental rate of $50, to be paid at the end of the week on Saturday. The worker occupied the room and paid the rent for several months before learning on a Tuesday that his job would be finished the following day. That same Tuesday evening, the worker gave an oral notice of termination to the landlord.

There is no applicable statute.

Assuming that the landlord is unable to find someone else to rent the room, how much rent is the worker obligated to pay?

| A. | $150, because the worker's notice would terminate the lease immediately. | |

| B. | $350, because the worker's notice would terminate the lease at the end of the current period, on Saturday. | |

| C. | $500, because the worker's notice would terminate the lease seven days after notice was provided, on the following Tuesday. | |

| D. | $700, because the worker's notice would terminate the lease at the end of the next full period, on the following Saturday |

A periodic tenancy lasts for a set period of time and then automatically renews at the end of each period (eg, on a weekly basis). Either party can terminate this tenancy at the end of a full period by giving the other party notice before that period begins. This means that notice given during the current period is effective to terminate the tenancy on the last day of the following period.

Here, the worker rented the room on a weekly basis (periodic tenancy), with the weekly period to start on Sunday. The worker gave an oral notice of termination to the landlord on a Tuesday evening, which was effective to terminate the worker's tenancy at the end of the next full period—the Saturday of the following week.* As a result, the worker is obligated to pay rent for the current week and the following week ($350 + $350), or a total of $700.

*An oral notice of termination is sufficient under the common law to terminate a periodic tenancy. However, most jurisdictions have enacted statutes that require some form of written notice (not seen here).

(Choice A) $150 represents the amount of rent that the worker would have been obligated to pay if his termination notice had ended the tenancy immediately. That is because the worker had occupied the room for the first three days of the week (Sunday through Tuesday), and the per-day portion of the weekly rent is $50.

(Choice B) $350 represents the amount of rent the worker would have been obligated to pay if his termination notice had been effective at the end of the current term.

(Choice C) $500 represents the amount of rent that the worker would have owed if his termination notice had ended the tenancy after the length of a period. This amount includes the $150 ($50 × 3) for Sunday through Tuesday and $350 for the seven days after notice was given.

Educational objective:

Either party can terminate a periodic (eg, week-to-week) tenancy at the end of a full period by giving the other party notice before the period begins. This means that notice given during the current period is effective to terminate the tenancy on the last day of the following period.

- Restatement (Second) of Property: Landlord & Tenant § 1.5 (Am. Law Inst. 1977) (periodic tenancy).

Frequently Answered Questions

What are the 5 Real Property topics covered on the MBE?

Real Property bar exam questions on the Multistate Bar Exam will be evenly distributed among 5 major areas:

- Ownership in Real Property

- Rights in Real Property

- Real Estate Contracts

- Mortgages/Security Devices

- Titles

Is Real Property on the MEE?

The Multistate Essay Exam (MEE®) regularly tests Real Property. An average of 1 question is conducted each year on Real Property. Questions on Real Property are generally not combined with other subjects. Many students find Real Property challenging. Focusing on the highly tested issues is the best way to prepare for Real Property on the MEE.